Is Debt Defining Your Life?

Take Control With Our Tailored IVA Debt Relief Programmes

Over £55 million of debt managed, trusted by thousands - your journey starts here.

An IVA is not suitable in all circumstances. Fees apply. Your credit rating may be affected.

Feeling Stuck? We Understand The Weight Of Debt.

These are some of the most common challenges our clients faced - and overcame with our help.

Constant Calls and Letters

Creditor calls and letters can feel endless and overwhelming. With an IVA from NDH Financial, those calls stop, giving you peace of mind and one affordable monthly payment to manage your debts.

Sleepless Nights Worrying About Debt

Debt anxiety can rob you of sleep and peace. NDH Financial specialises in IVAs that provide a clear plan to manage your debts, helping you rest easier knowing a solution is in place.

Feeling Judged or Alone

Debt can feel isolating, but at NDH Financial, there’s no judgment—just support. Our friendly consultants listen with care and guide you towards the right solution with respect and understanding.

Confusion About Debt Solutions

Debt solutions can be confusing, but you don’t have to navigate them alone. NDH Financial explains everything clearly and helps you understand if an IVA is the right fit—all in straightforward, jargon-free language.

Fear of Losing Control

Debt can make life feel stuck. NDH Financial’s IVA solutions provide a structured way to regain control of your finances, helping you move forward with confidence.

Fear of Losing Assets

Worried about losing your home or car? An IVA protects essential assets while making your debts manageable. NDH Financial’s experienced team will ensure your needs are fully considered.

Threat of Legal Action

Bailiffs, wage deductions, repossessions—legal threats from creditors are terrifying. An IVA stops these actions, giving you legal protection and a structured way to address your debts.

Feeling Trapped in a Cycle of Debt

Debt can feel endless, but an IVA offers a clear timeline to manage it. With one affordable payment and up to 73% of your debts written off, NDH Financial helps you take that first step toward stability.

Have questions? Let's chat privately first.

We understand talking about debt can feel overwhelming—but you don’t have to face it alone.

Messaging us on Facebook Messenger is quick, confidential, and judgement-free. Our friendly consultants are here to answer your questions, at your pace.

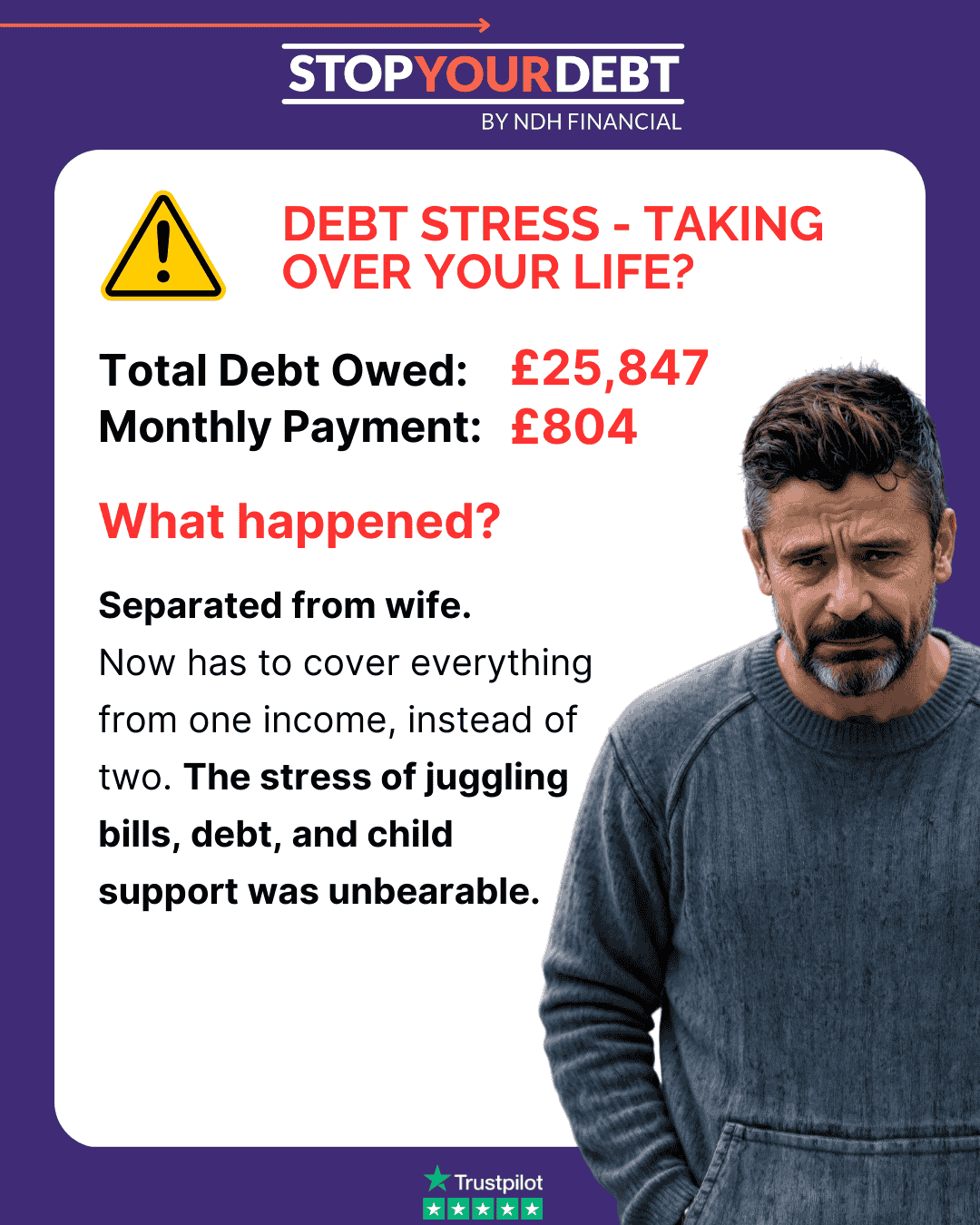

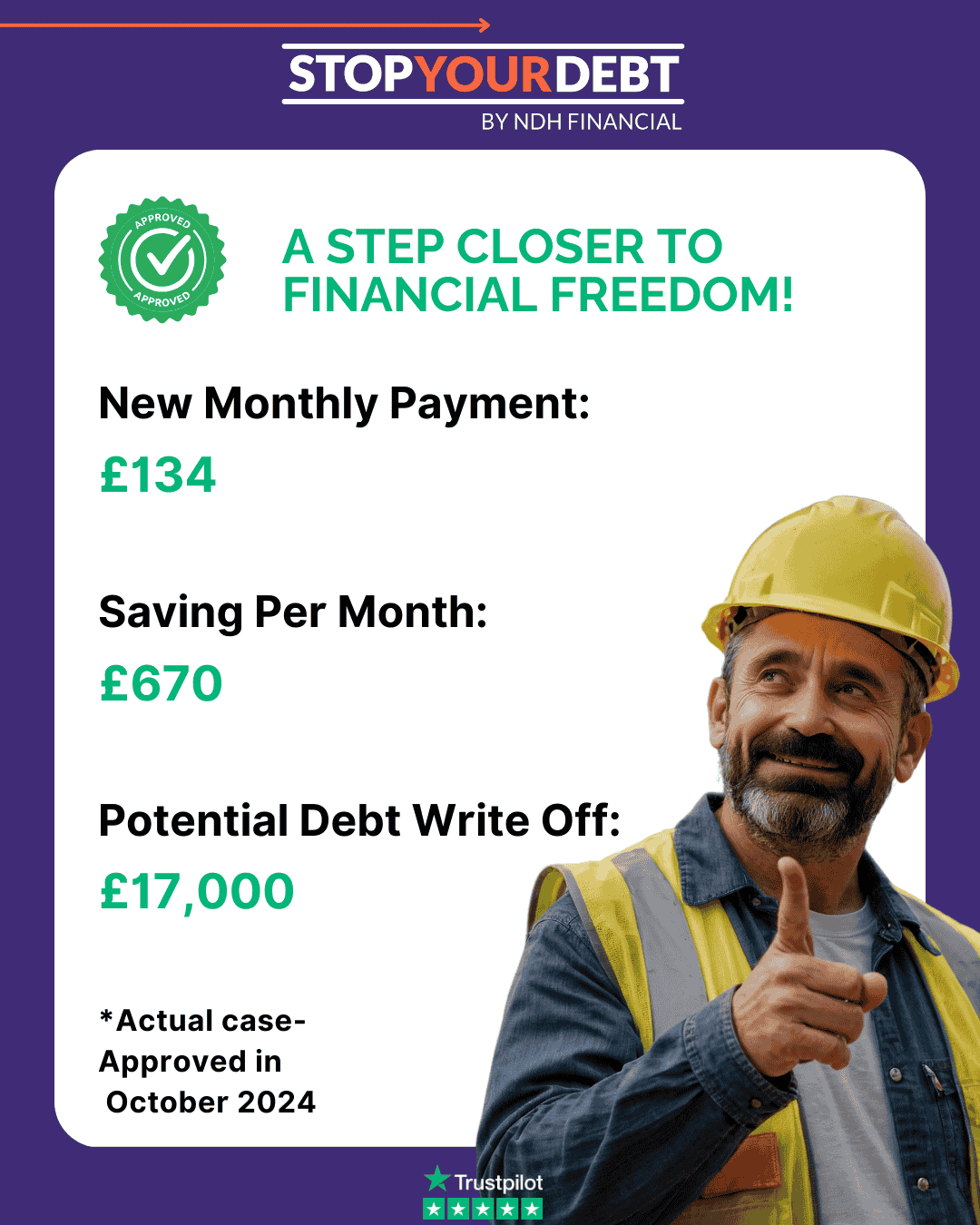

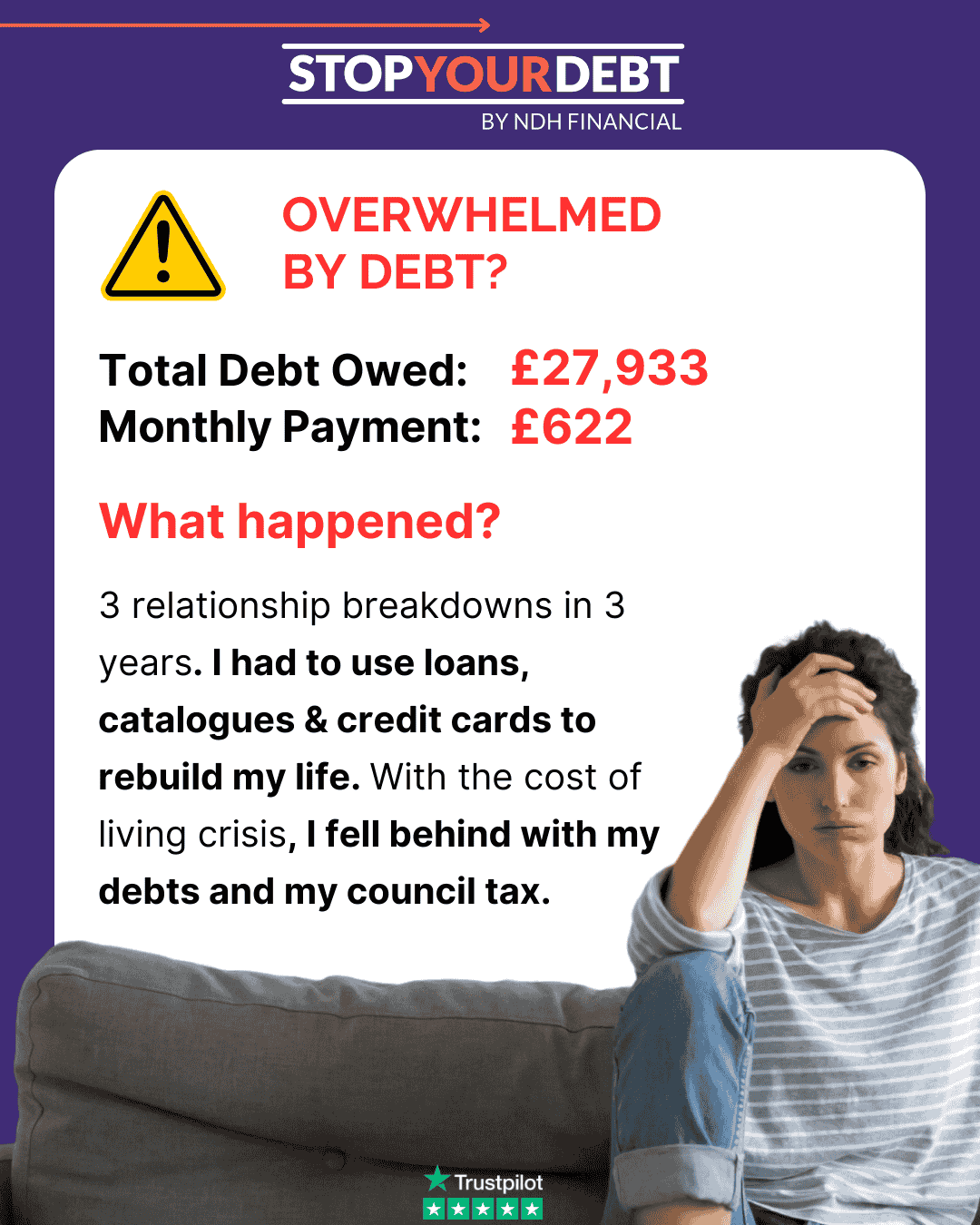

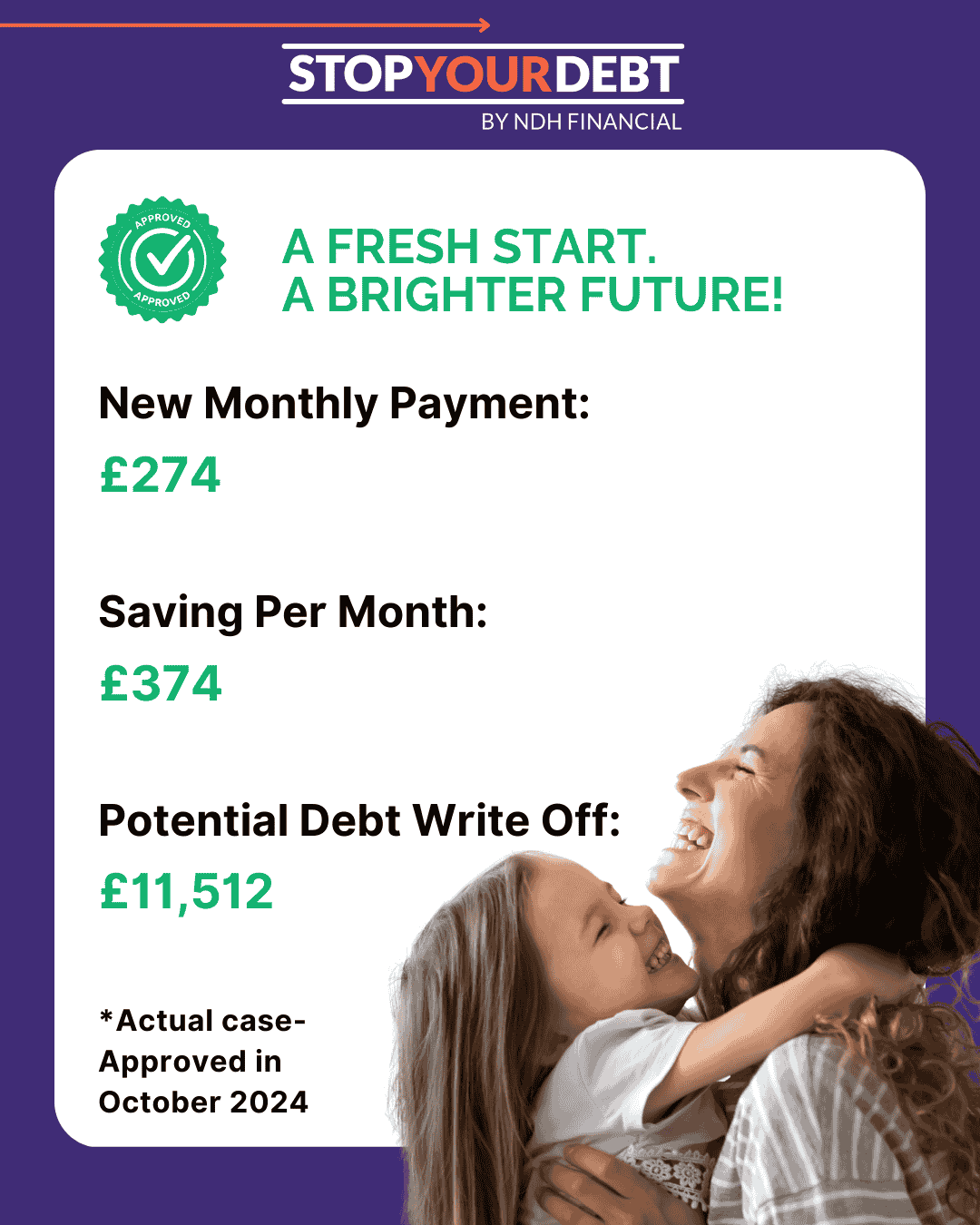

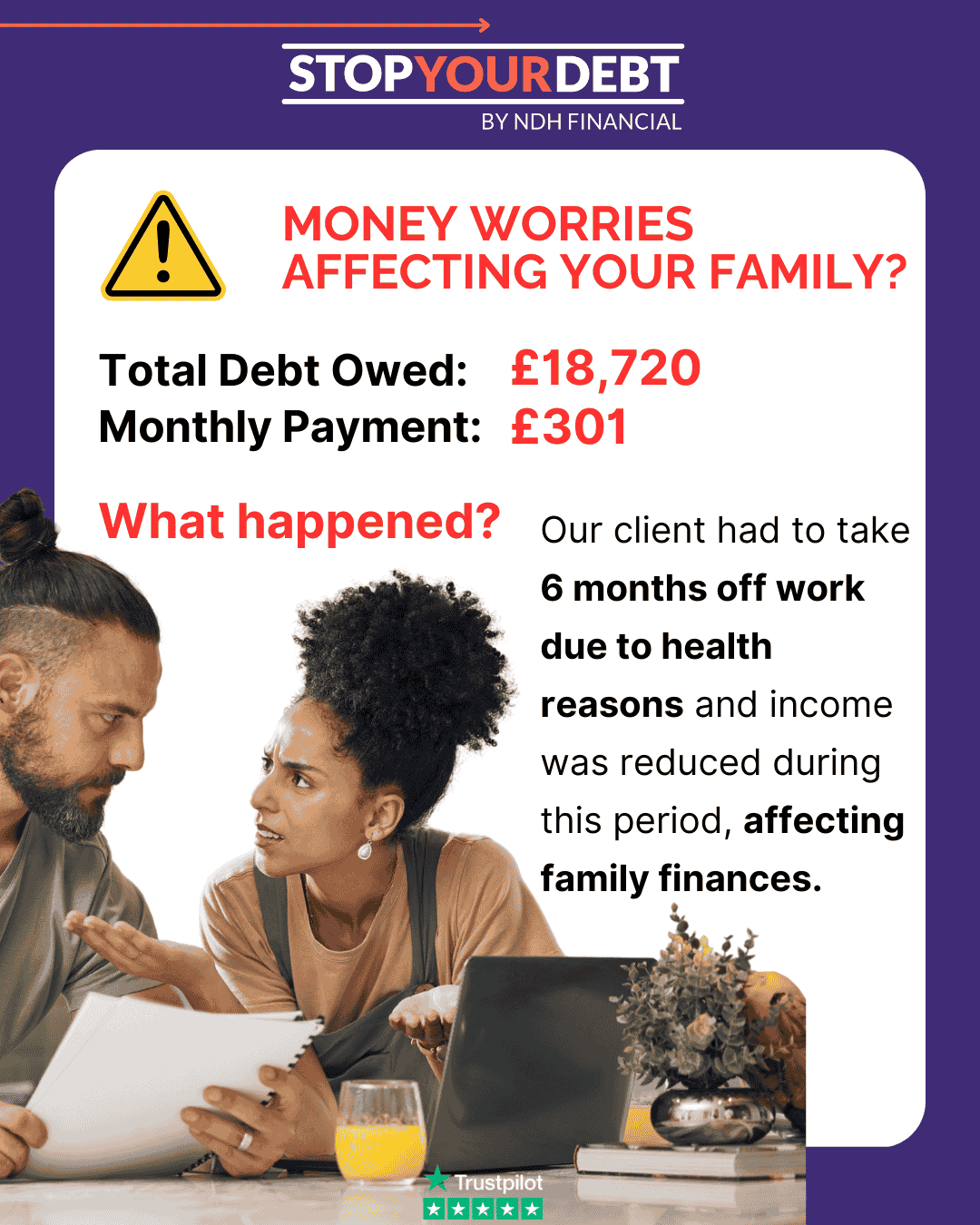

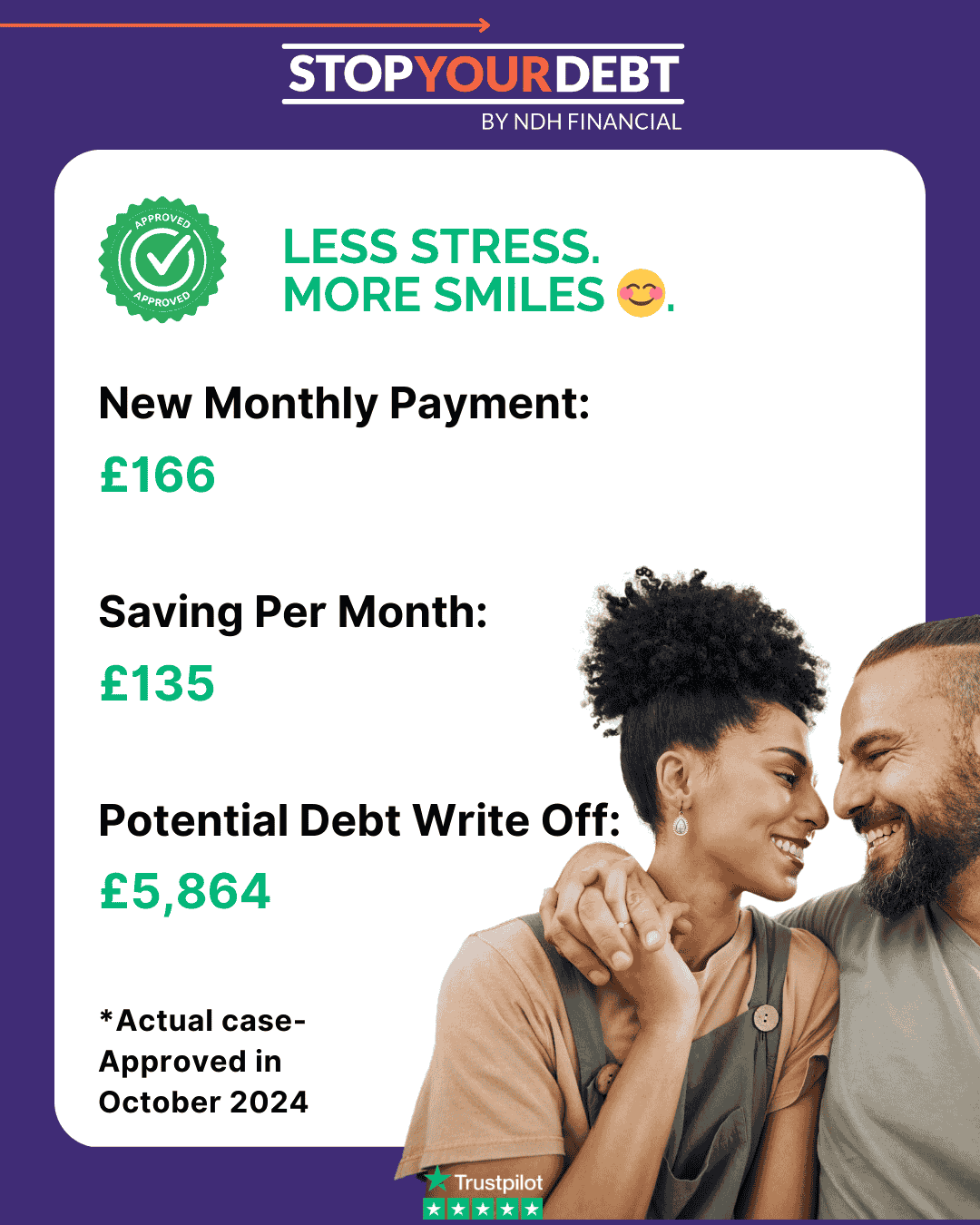

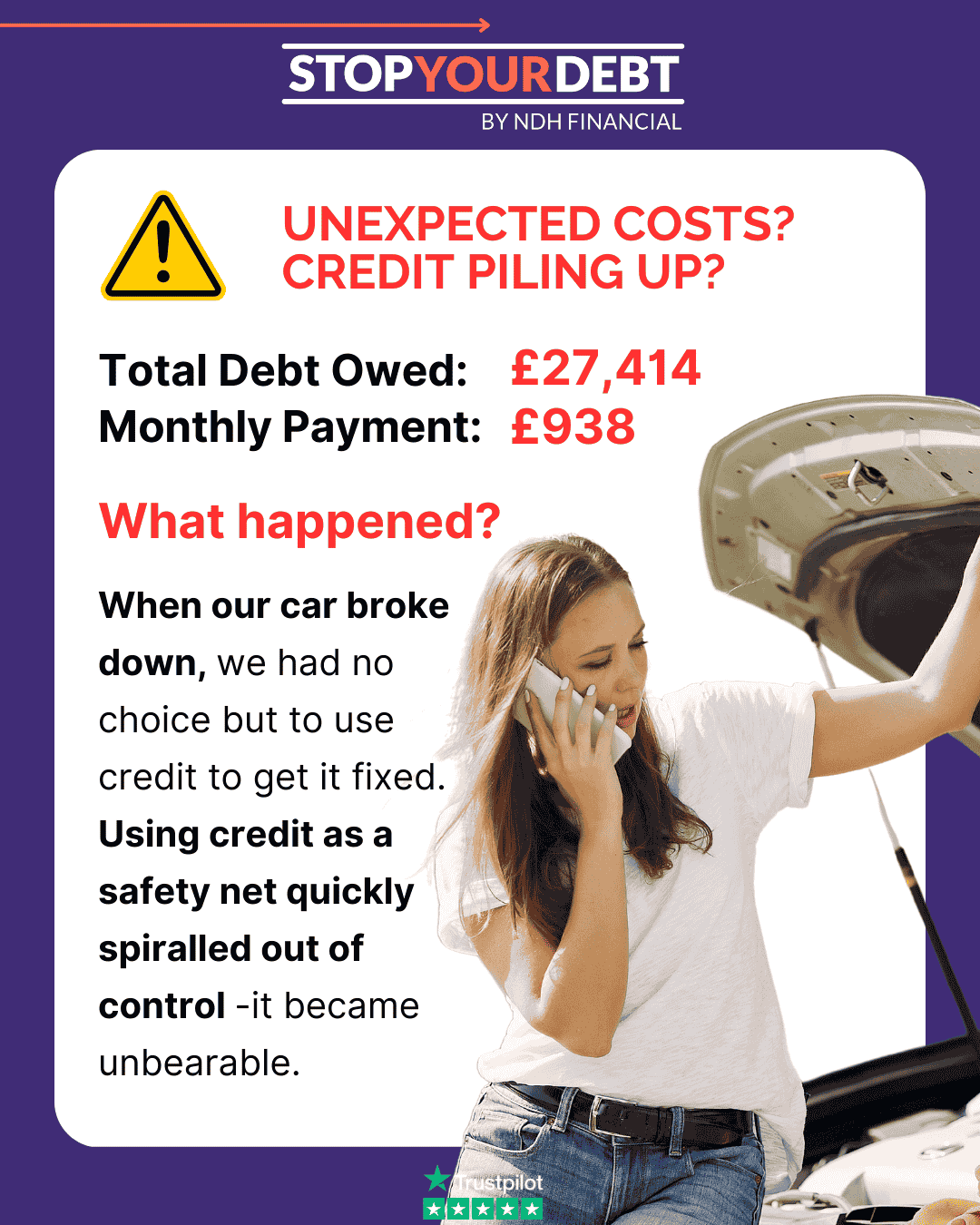

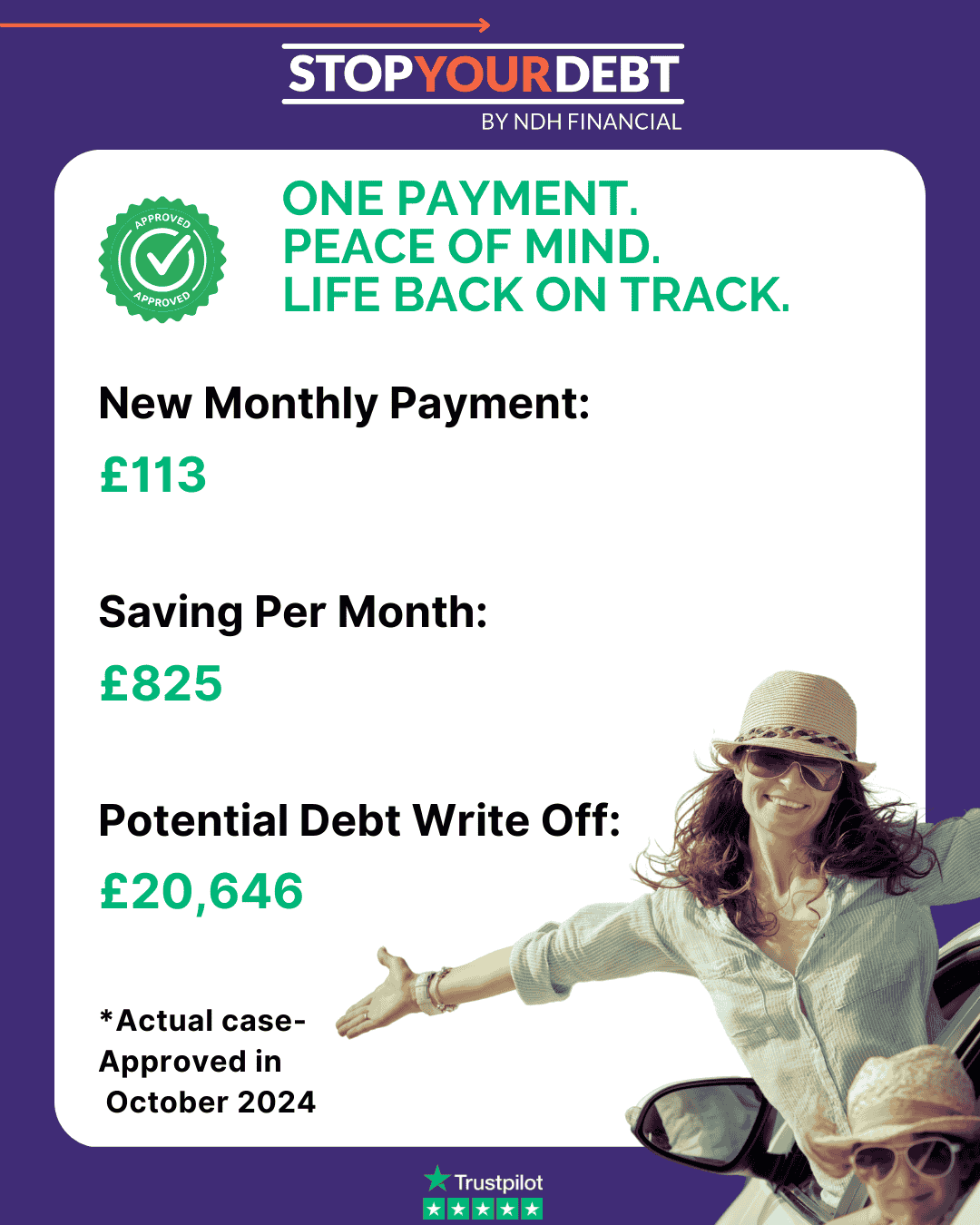

Real People. Real Results. Trusted by Thousands Across The UK

Join thousands who’ve taken control of their finances. With £55 million in debt managed and over 2,000 5-star reviews, NDH Financial delivers trusted IVA solutions tailored to your needs.

Take Control With An Individual Voluntary Arrangement (IVA)

Our tailored IVA solutions are designed to bring clarity and structure for people struggling with debts over £8000. With one affordable monthly payment, you can freeze interest and charges, stop creditor contact, and after the agreed period, have any unaffordable debt legally written off. It’s a practical way to regain control and move forward with confidence.

Want to know more? Explore the key benefits of an IVA below by clicking on the topics that matter most to you for a simple breakdown of how it all works.

1. Combine Your Debts Into One Affordable Payment:

Managing multiple debts can feel overwhelming. With an IVA, all your unsecured debts are consolidated into a single, affordable monthly payment, based on what you can realistically afford. This makes budgeting simpler and gives you more control over your finances

2. Freeze Interest and Charges:

Rising interest and charges can make your debt feel impossible to clear. An IVA freezes interest and additional fees, so your debt stops growing. This means every payment you make goes toward reducing what you owe, giving you a clear path forward

3. Stop Creditor Contact and Legal Action:

Constant calls, letters, and the threat of legal action can feel relentless. An IVA provides legal protection, so creditors can no longer contact you or take action against you, like sending bailiffs or deducting from your wages. You’ll have the breathing space to focus on your repayment plan.

4. Legally Write Off Up to 73% of Unaffordable Debt:

At the end of your IVA’s agreed term, up to 73% of your remaining unaffordable debt is legally written off. This gives you a fresh start and the chance to move forward with your life without the weight of unmanageable debt holding you back.

5. Protect Essential Assets:

Worried about losing your home, car, or other important belongings? An IVA protects essential assets, so you can keep what matters most while working to resolve your debts. We’ll help you create a plan that considers your unique circumstances.

6. Fixed Timescale for Clarity:

Unlike the uncertainty of ongoing debt repayments, an IVA gives you a clear end date—typically five to six years. Knowing when your IVA will be complete helps you plan for the future with confidence and peace of mind.

7. Affordable Payments Based on Your Budget:

Your IVA is tailored to your financial situation, with payments calculated based on what you can reasonably afford after essential expenses. This ensures you’re not overstretched and can focus on making steady progress.

8. We Handle the Hard Work for You:

Dealing with creditors and managing debt negotiations can feel overwhelming. At NDH Financial, we take care of it all for you—communicating with creditors, setting up your IVA, and guiding you every step of the way. You’ll never have to face it alone.

9. Your Case Managed In-House from Start to Finish:

At NDH Financial, your case is always handled by our in-house team of experts. From your first call to the completion of your IVA, you’ll work with the same dedicated team who knows your situation personally. This ensures consistent, clear, and compassionate support throughout your journey.

10. Legal and Transparent Process:

Our licensed Insolvency Practitioner is regulated by the ICAEW, ensuring your IVA is handled with professionalism and integrity. We prioritise transparency at every step, so you’ll always know exactly what to expect.

Check Your Eligibility Now

Let's take the first step together - see if you qualify for a no-obligation consultation today!

7 Steps To Regaining Financial Control. Here’s How An IVA Works:

From your first enquiry to resolving your debts, learn how we guide you through every step of the IVA process.

What’s Holding You Back? Let’s Address Your Concerns:

You’re not alone in having questions about IVAs—it’s a big decision, and one we want you to make with your eyes wide open.

Below, we’ve answered the most common concerns to help you feel confident and ready to take that first step. Anything you are unsure about, just pop us a message or book a no obligation consultation with our friendly team of experts.

I feel embarrassed about being in debt—how will I be treated?

At NDH Financial, there’s no judgment—only support. We understand that debt happens to everyone for different reasons, and we’re here to help you find a solution. Our friendly consultants treat every client with respect and empathy, helping you take control of your finances without feeling embarrassed.

Will I lose my home or car if I enter an IVA?

An IVA is designed to be manageable and protect your essential assets. If you’re worried about your home or car, we’ll work with you to make sure they are protected, as long as they are necessary for daily living. We understand how important your belongings are, and we take that into account when structuring your IVA.

What if my creditors don’t agree to the IVA?

While most creditors agree to an IVA, there is always a chance some may not. If the IVA is not approved, any other debt solutions available to you before the IVA was proposed will remain options. During the IVA proposal process, we’ll handle all communication with your creditors and keep you informed every step of the way. If your IVA isn’t approved, we’ll point you in the direction of alternative support to help you move forward.

I’ve heard my credit rating will be ruined—is that true?

Yes, your credit rating will be impacted during the IVA, as it’s a formal debt solution. However, once your IVA is completed, you’ll be in a much better position to rebuild your credit over time. The most important thing is that you’ll be free from overwhelming debt and can start building a more stable financial future.

Can creditors still contact me or take action against me during the IVA?

Once your IVA is in place, creditors are legally barred from contacting you, and any action they were planning (like bailiffs or wage deductions) is stopped. You’ll have peace of mind, knowing that NDH Financial is working on your behalf to protect you from further stress.

What happens if my circumstances change during the IVA?

Life happens, and things may change during the IVA. If you lose your job, experience a drop in income, or have unexpected expenses, it’s important to speak with us immediately. We can work with you to adjust your IVA or seek your creditors’ approval to make changes, ensuring it remains manageable. Whatever challenges you face, we’ll be here to support you every step of the way.

I don’t think I can afford an IVA—won’t it cost more than I can manage?

We understand that affordability is a major concern. With an IVA, your monthly payments are tailored to your specific income and expenses. You only pay what you can afford, and the IVA will give you the breathing room to manage your finances more effectively

I’ve Been Managing My Debt Myself—Why Should I Trust Someone Else?

Managing debt on your own can feel exhausting and overwhelming, especially when creditors keep calling, and progress seems out of reach. At NDH Financial, we’ve helped thousands of people across the UK take control of their debts, managing over £55 million in client debt and earning over 2,000 verified 5-star reviews along the way.

Our Licensed Insolvency Practitioner bring 15 years of industry experience to guide you through every step of the IVA process. You’ll never feel alone—we handle the heavy lifting, from liaising with creditors to crafting a clear, realistic plan tailored to your circumstances. Our goal is to empower you to focus on moving forward with confidence, knowing you have trusted experts by your side..

What debts can be included in an IVA?

An IVA can include most unsecured debts, such as credit cards, loans, overdrafts, personal loans, payday loans, and council tax arrears. If you’re unsure about any specific debts, we’ll go over everything with you during your consultation.

How long does an IVA last?

Typically, an IVA lasts between 5 and 6 years. This gives you a clear, manageable path toward resolving your debt. At the end of the agreed period, any remaining unaffordable debt is legally written off, providing a fresh start.

How much of my debt will be written off?

One of the biggest benefits of an IVA is that it gives you a clear, structured path to resolve your debts. At the end of your IVA, any remaining unaffordable debt—up to 73% in many cases—will be legally written off, giving you a fresh start.

This means you won’t be burdened by debts you can’t repay, and you can focus on moving forward with confidence. Whether it’s planning for the future, rebuilding your credit, or simply enjoying the relief of not being chased by creditors, an IVA provides a way to regain control and take back your financial independence.

At NDH Financial, we’re here to guide you through every step of the process, so you can feel empowered to make a change and take that all-important first step toward a brighter future.

What are the eligibility criteria for an IVA?

To be eligible for an IVA, you need to have over £8,000 in unsecured debt, and your debt must be unaffordable within your current financial situation.

How are monthly payments calculated?

Your monthly IVA payments are tailored to your financial circumstances, ensuring they’re affordable and sustainable over the full term of the agreement.

To determine what you can afford, we’ll work with you to create a detailed budget based on the Standard Financial Statement (SFS) guidelines. This budget covers all your essential living expenses—including housing, utilities, groceries, and transport—but also makes allowances for:

✔️ Sundries and leisure activities, so you can still enjoy small treats and outings.

✔️ Christmas presents, birthdays, and other important family occasions.

✔️ Unexpected costs like car repairs or medical expenses, ensuring you have a safety net.

An IVA isn’t about living on bread and water—it’s about finding a balance that allows you to manage your debts while still enjoying a reasonable quality of life.

What happens after an IVA is completed?

Completing an IVA is a significant achievement—one that many clients describe as life-changing. Over the five to six years of your IVA, you’ll have learned to live within a structured budget, prioritise what truly matters, and move away from relying on credit to make ends meet.

By the time your IVA is completed, any remaining unaffordable debt is legally written off. More importantly, you’ll have gained financial confidence and valuable money-management skills that can set you up for a brighter, more stable future.

Can I Get Credit During an IVA?

Generally, you’re not allowed to take out new credit during an IVA without prior permission.

However, there are exceptions. For example:

✔️ Financing a replacement car if your current vehicle is no longer roadworthy.

✔️ Universal Credit advances or similar government support payments.

✔️ Student finance, as it supports education without creating unnecessary financial strain.

It’s important to discuss any credit needs with your IP. At NDH Financial, we’ll help you understand the rules and guide you through any exceptions.

What Happens if I Inherit Money or Get a Windfall During My IVA?

If you receive a lump sum—such as an inheritance, a lottery win, or another unexpected windfall—during your IVA, it’s important to let your Insolvency Practitioner (IP) know immediately. Depending on the terms of your IVA, this money may need to be used to repay your creditors.

However, there’s good news:

✔️ You will never pay back more than 100% of what you owe, plus your agreed IVA fees.

✔️ In some cases, if the lump sum is large enough, your IP may be able to negotiate an early settlement of your IVA. This could allow you to complete your IVA sooner than planned and move forward without ongoing repayments.

Every situation is unique, so it’s important to discuss your circumstances with your IP. At NDH Financial, we’ll guide you through this process, ensuring you understand your options and feel confident about what comes next.

How Does Car Finance Work in an IVA?

At NDH Financial, we understand how important your car is—whether it’s for work, family, or daily life. In most cases, you can keep your hire purchase vehicle during an IVA as long as:

✔️ The monthly payments are affordable and fit within your IVA budget.

✔️ The car is essential for your needs, like commuting or family commitments.

If your car is considered a luxury or no longer affordable, we’ll work with you to explore options, like downgrading to a more practical vehicle.

If your car finance agreement ends during your IVA or you need to replace an essential vehicle, this can often be arranged—provided the new agreement aligns with your budget.

At NDH Financial, we’re here to help you navigate these situations with confidence and ensure your IVA works for your circumstances.

What is the Remortgage Clause in an IVA?

If you’re a homeowner, your IVA may include a remortgage clause. This means that toward the end of your IVA, typically in the fifth year, you’ll be asked to see if you can release equity from your property to contribute toward your debts.

It’s important to know:

✔️ You’ll only be asked to attempt a remortgage if it’s affordable and fits standard lending criteria.

✔️ If you’re unable to remortgage, you won’t be asked to sell your home. Instead, your IVA will usually be extended by 12 months, giving you an extra year to make payments instead.

Unlike bankruptcy, an IVA is designed to protect your home, not put it at risk. At NDH Financial, we’ll explain this process in detail and support you every step of the way, ensuring you fully understand how it works and how your home will be protected.

What Happens if I Have Deductions From My Wages or Benefits?

If your wages or benefits are being deducted to repay debts, it can feel like you have no control over your finances. These attachments, often enforced by creditors, can make it harder to cover essential living costs and leave you feeling trapped.

When your IVA is approved, any existing wage or benefit attachments are legally stopped. This means:

✔️ You regain control of your income, making it easier to budget for your essential needs.

✔️ Your monthly IVA payment is calculated based on what you can afford, so you’ll no longer struggle to make ends meet.

✔️ The stress of seeing automatic deductions disappear from your paycheck or benefits is lifted, giving you peace of mind.

At NDH Financial, we’ll guide you through this process, ensuring your IVA is tailored to your circumstances and provides the relief you need.

I’m Self-Employed—Can I Still Get an IVA?

Absolutely! At NDH Financial, we specialise in supporting self-employed individuals through the IVA process. We understand the unique challenges you face—irregular income, cash flow forecasting, and dealing with HMRC—and we’re here to help.

Unlike many insolvency practices that shy away from complex cases, we believe self-employed people deserve tailored solutions. Our experienced team will work closely with you to:

✔️ Create a realistic repayment plan that fits your business income.

✔️ Navigate the paperwork, including proof of income and financial forecasts.

✔️ Handle communications with creditors, including HMRC, to reduce stress.

Whether you’re a sole trader or running a small business, we take the time to understand your situation fully. We’ll guide you through every step of the process, giving you the confidence and support to move forward while keeping your business running.